Key Takeaways

- A customs bond guarantees payment of import duties and ensures compliance with CBP regulations, required for commercial imports over $2,500 or goods regulated by federal agencies like the FDA or EPA.

- Importers can choose between single entry bonds for one-off shipments or continuous bonds covering all imports for 12 months, depending on frequency and volume.

- Underestimating bond amounts, using the wrong bond type, or missing renewals are common errors that delay clearance and add costs.

- Working with licensed brokers simplifies bond application and ensures proper documentation, minimizing CBP rejections and penalties.

- Wisor reduces quote turnaround by 85% and automates customs bond management with real-time shipment tracking, compliance checks, and analytics, cutting costs and boosting operational efficiency.

Importing goods into the United States requires more than logistics and paperwork, and a customs bond is often the key to smooth clearance. It acts as a financial guarantee to the U.S. Customs and Border Protection (CBP), ensuring all import duties, taxes, and fees are paid. Whether you are importing only once or you run regular trade, it is essential to know what a customs bond is, how it works, and its different types.

What is a Customs Bond?

A customs bond can simply be described as a financial guarantee that payment of all applicable import duties, taxes, and fees will be paid in full. This agreement is between three parties. First is the importer, then the Customs and Border Protection (CBP), and last is the surety company.

The customs bond gives the importer a legal obligation to comply with customs regulations and pay all import duties. If the importer fails to meet their obligations, the surety company will cover the full amount, and then the importer will reimburse the surety company afterwards.

The customs bond applies to most commercial imports valued at more than $2,500, or in cases when the imported goods are subject to federal agencies. For example, the FDA, USDA, or EPA.

Customs Bond vs. ISF Bond

Many who are new to importing goods have trouble making a distinction between a customs bond and an Importer Security Filing (ISF) bond. Although both are classified as import bonds, they serve very different purposes and are required at different stages of the import process.

To make the distinction clearer, below is a comparison table that highlights their unique features, filing requirements, and use cases, helping importers understand which option applies to their specific needs:

|

Feature |

Customs Bond |

ISF Bond |

| Purpose | The customs bond ensures the payment of import duties, taxes, and compliance with customs regulations. | ISF acts as a financial guarantee for importers, ensuring that specific data points are submitted to the U.S. Customs and Border Protection (CBP) before the cargo is loaded onto a vessel. |

| Who Requires It | A customs bond is required only by importers of commercial imports with a value over $2,500 or goods that are regulated by federal agencies. | Importers must submit ISF data specifically for ocean freight shipments, as mandated by CBP. This filing provides CBP with advance information about the cargo before it departs from the foreign port, ensuring compliance and enhancing supply chain security. |

| When It’s Filed | A customs bond is filed at the time of entry with Customs and Border Protection. | ISF is filed before the cargo is loaded at the foreign port (at least 24 hours before). |

| Coverage | Customs bond coverage is extensive; it covers duties, taxes, penalties, and compliance liabilities. | ISF bonds apply to individual ocean shipments, though frequent importers may arrange continuous ISF coverage to simplify compliance. |

| Validity | They can be single entry bonds or continuous bonds covering all shipments for 12 months. | ISF filings are shipment-specific, but importers can obtain continuous ISF bonds that remain valid for 12 months. |

| Common Users | Frequent importers, businesses with regular shipments, non-resident importers. | Ocean freight importers who must comply with ISF rules. |

| Managed By | Customs bonds are managed directly by the importer, or through customs brokers or surety companies. | ISF is usually filed by customs brokers or freight forwarders with freight management software on behalf of the importer. |

Types of Customs Bonds

There are three different types of customs bonds that vary based on shipment frequency and business activity. Choosing the right one will ensure full compliance and will prevent any clearance issues:

1. Single Entry Bond

Single entry bonds, also known as single transaction bonds, apply to one shipment only. These are common for small importers or businesses that import goods occasionally. The bond amount is the value of the goods, applicable import duties, taxes, and fees. Platforms like Wisor can also help importers estimate and optimize freight forwarder fees, reducing surprises in the process.

2. Continuous Bond

Continuous bonds, also known as continuous customs bonds, cover all of the shipments the importer makes over a 12-month period. They are perfect for regular importers. When it comes to continuous bonds, the bond amount is typically 10% of the total duties, taxes, and fees paid in a year, with a minimum set by the Customs and Border Protection (CBP).

3. Activity-Specific Bonds

In addition to single entry and continuous bonds, certain business activities require specialized customs bonds. These bonds are tailored to specific roles within the supply chain and ensure compliance with CBP regulations in more specialized contexts:

- Airport Security Bonds: Required for carriers or companies that operate within secured airport areas, ensuring compliance with CBP security standards.

- Bonded Warehouse or Custodian Bonds: Needed for companies that manage bonded warehouses or store goods prior to clearance, guaranteeing proper handling and reporting.

- International Carrier Bonds: Required for operators such as shipping lines, airlines, and other transport providers to cover the transit and custody of international cargo moving through U.S. ports.

These activity-specific bonds provide targeted coverage, ensuring that businesses engaged in specialized operations meet regulatory requirements and avoid costly disruptions.

Key Features of Customs Bonds

Understanding the key features of customs bonds is essential for importers who want to stay compliant and manage their shipments efficiently. By knowing how these bonds function, what they cover, and the liabilities involved, you can make better decisions when choosing the right bond and avoid potentially costly errors that may delay your imports or increase your expenses:

Coverage Amount and Liabilities

Customs bonds must cover not only the value of the shipment but also potential penalties and compliance liabilities. If duties and fees are not paid in full, the bond ensures that CBP is reimbursed. The importer, however, remains responsible for repaying the surety company that issued the bond.

Link with Importer’s Business Profile

CBP evaluates the sufficiency of a customs bond based on the importer’s overall activity and risk profile. Importers dealing with high-value shipments, sensitive commodities, or frequent commercial imports are often required to secure higher bond amounts to ensure adequate coverage for duties, taxes, and potential penalties. This process helps CBP maintain compliance standards while safeguarding government revenue.

Applicability for Residents and Non-Residents

Customs bonds apply to both U.S. companies and foreign importers with goods entering the country. Non-resident importers can obtain the necessary bond through licensed customs brokers or U.S.-based surety companies authorized by CBP, ensuring compliance and smooth clearance.

When is a Customs Bond Required?

Customs bonds are required in a few scenarios, which are the following:

- If you plan to import goods that are valued above $2,500.

- If the goods you plan to import are subject to federal agencies like the FDA, USDA, or EPA.

- If the importer wants to expedite the clearance of commercial imports.

Even when not strictly required, customs bonds can expedite CBP processing by signaling full compliance upfront.

How to Get a Customs Bond

Obtaining a customs bond is generally a straightforward process, but it requires careful attention to detail. Importers can apply for a bond directly with a surety company or, more commonly, work through licensed customs brokers who manage the process on their behalf. Having the right documentation ready and understanding which type of bond fits your import activity can make the process faster and more efficient.

Choosing the Right Bond Type

If you are an occasional importer, opting for single entry bonds is a good idea. If you import regularly, continuous bonds are the best solution for your use case.

Applying Through a Broker or Surety Company

Typically, importers work with licensed customs brokers or surety companies that file the bonds electronically with the CBP.

Documents Required to Apply for a Customs Bond

Usually, bond applicants need to provide:

- Importer of Record (IOR) number or Employer Identification Number (EIN).

- Company details and contact information.

- Estimated shipment costs and import duties.

Costs and Bond Amount Calculation

Usually, the cost of the bond depends on the bond type and amount. Let’s take the following example:

- Single entry bonds calculation is simple, $5.50 per $1,000 of the bond amount.

- Continuous customs bonds usually start at about $350 annually but vary greatly depending on the shipment value.

CBP requires the bond amount to be equal or at least to 10% of your yearly duty and tax liabilities.

Renewal Process for Continuous Bonds

Continuous bonds require renewal every 12 months. Usually, importers, or their customs brokers handle renewals to prevent delays.

Common Mistakes to Avoid with Customs Bonds

Many first-time importers make avoidable mistakes when it comes to customs bonds, often underestimating their importance in the clearance process. By being aware of these pitfalls, importers can better prepare for smooth operations:

|

Mistake |

Description |

Consequence |

| Underestimating Bond Amounts | The importer sets the bond too low for the shipment value and applicable import duties. | CBP will reject the bond, resulting in delays and penalties. |

| Using the Wrong Bond Type | The importer chooses a single entry bond instead of a continuous bond, or vice versa. | The importer pays higher fees for frequent shipments or has insufficient coverage. |

| Ignoring Bond Expiry or Renewal | The importer allows the continuous customs bond to expire without renewal. | Shipments are stuck and cannot clear till the bond is renewed. |

| Assuming One Bond Covers All Shipments | The importer thinks that a single bond applies to all imports. | Big risk of the shipments being held if not linked to a valid and sufficient bond |

Best Practices for Importers for Customs Bonds

Adopting best practices for customs bond management enables importers to maintain compliance while streamlining their shipping processes. These practices not only reduce the risk of penalties but also help build trust with CBP and business partners:

- Select the Right Bond Type Early: Depending on your needs, choose a single entry bond or a continuous bond before you schedule your shipments.

- Ensure Bond Sufficiency for High-Value Imports: Make a calculation of the duty and tax fees, so you have clear expectations on the end costs.

- Track Bond Validity and Renew On Time: Make sure you set reminders for bond renewals. This way, you don’t have issues related to delays.

- Work With Experienced Brokers for Smooth Clearance: A skilled customs broker can simplify filing, reduce errors, and help importers avoid costly compliance mistakes.

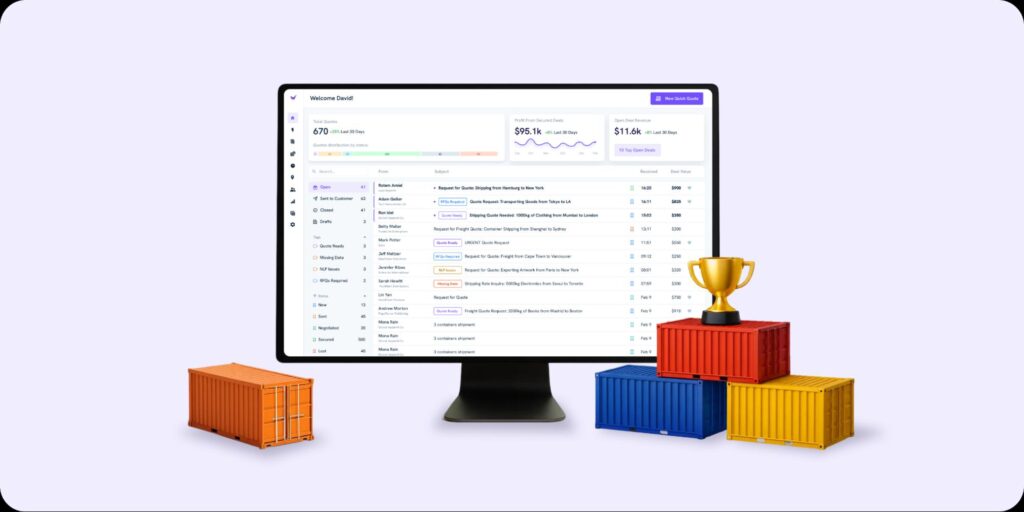

Streamlining Bonded Shipments and Compliance With Wisor

Wisor provides importers with a robust SaaS platform designed to simplify and optimize every step of customs bond management. Beyond bonds, Wisor delivers real-time visibility, automation, and data-driven insights that help businesses reduce costs, strengthen compliance, and refine trade operations over time.

- Simplifies Bond Selection and Application: Wisor guides you step by step in identifying and applying for the right type of customs bond for your business.

- Provides Full Visibility Into Bonded Shipments: The platform tracks compliance and clearance progress in real time, giving importers complete transparency into their bonded shipments.

- Automates Compliance and Documentation Checks: Wisor reduces human error by automating critical documentation checks, ensuring smoother interactions with CBP.

- Data-Driven Insights for Trade Optimization: Through analytics and reporting, Wisor empowers businesses to continuously optimize their trade processes and cut operational costs.

Conclusion

For any importer, having a clear understanding of customs bonds and their requirements is critical to running smooth and compliant operations. Selecting the right type of bond, whether single entry for one-off shipments or continuous bonds for ongoing imports, ensures that your goods clear customs without unnecessary delays. Equally important is keeping track of bond validity and renewal timelines, as missed renewals can disrupt shipments and create unexpected expenses.

By combining proper bond management with digital solutions, importers can significantly reduce risk. Platforms like Wisor simplify this process by offering end-to-end visibility, automated compliance checks, and actionable insights, giving businesses more control and confidence in managing bonded shipments.